Donation receipts can be slightly tricky to create since there are legal compliances you’ll need to follow. To make things easier, we’ve created a donation receipt template you can use for every giving scenario.

Use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives:

Here’s what we’ll cover:

Use an online donation receipt template for anyone who’s made a donate on your website. If you’re using Sumac nonprofit CRM, you can setup your receipts to send automatically after someone makes a donation on your website.

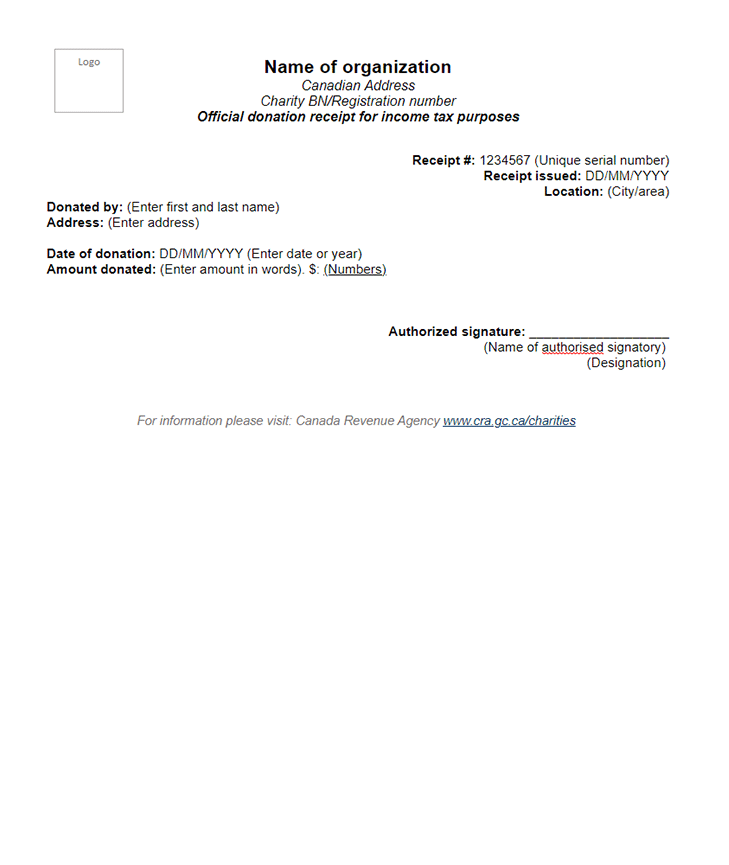

Use a cash donation receipt template for anyone who’d like to donate in cash. It’s especially important to make sure this is recorded to have proof of donation and prevent misuse. Use this donation receipt template for donors who have not received any merchandise in exchange for a donation.

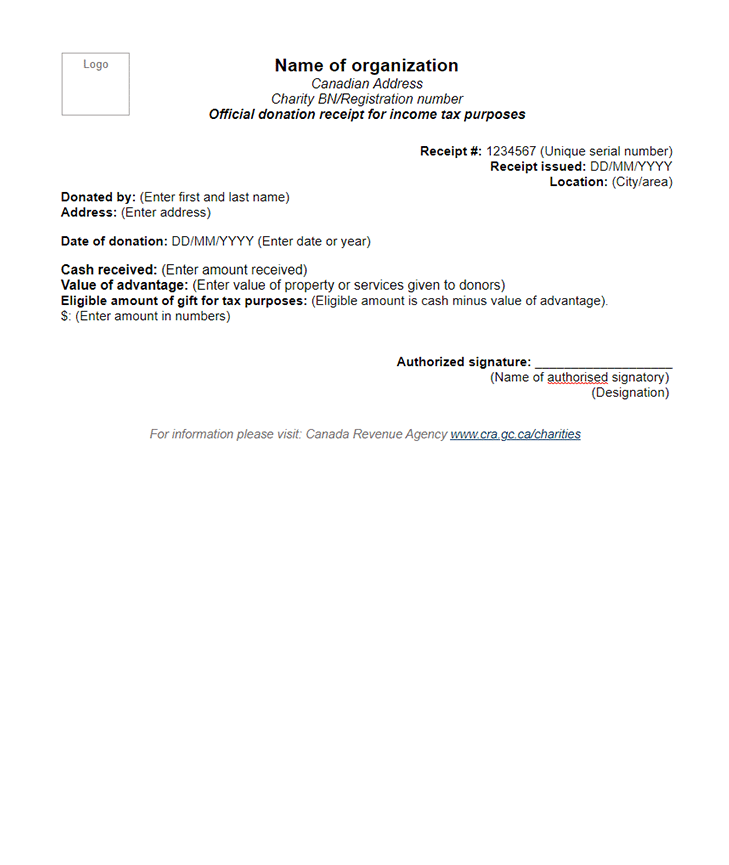

These donation receipts are issued when a donor receives a gift in return for a donation. This could be in the form of merchandise, a meal, or any services charities provide in exchange for donations. The taxable amount must take into account the cost of the gift and therefore requires a different donation receipt.

If the amount of the advantage is more than 80% of the cash gift, an official donation receipt cannot be issued.

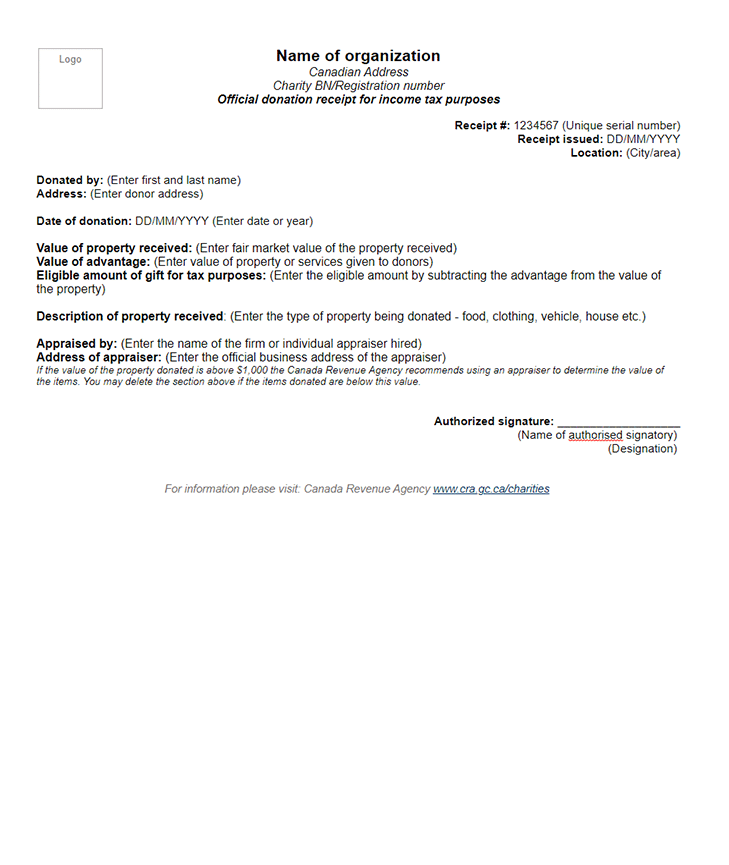

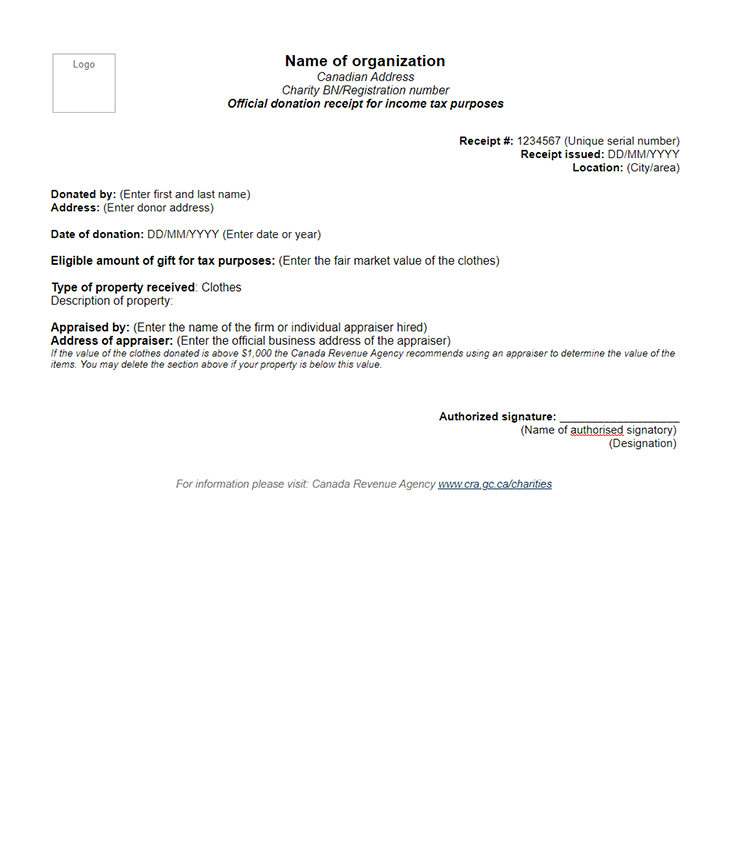

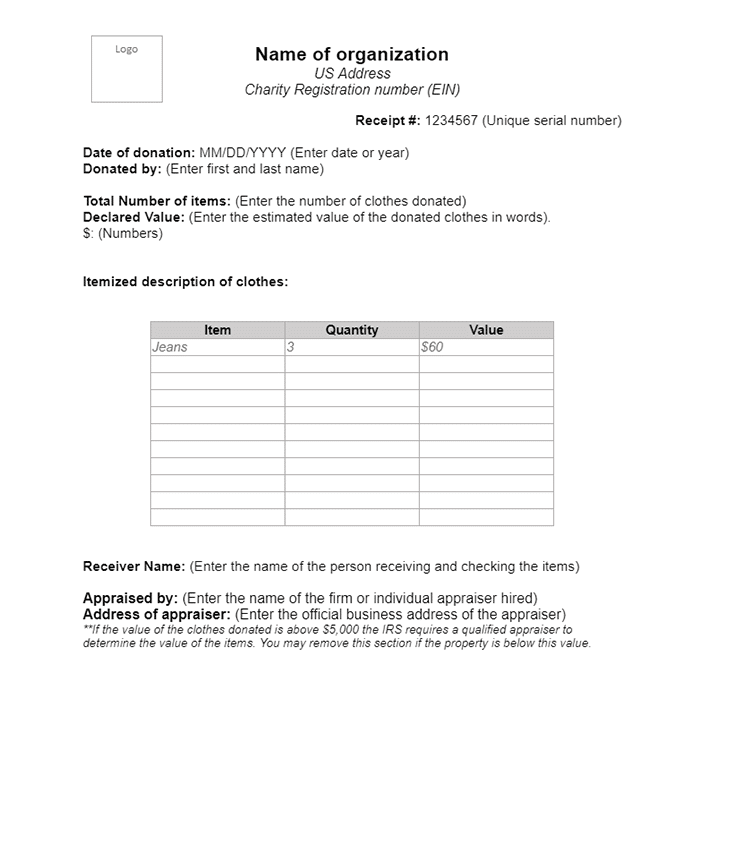

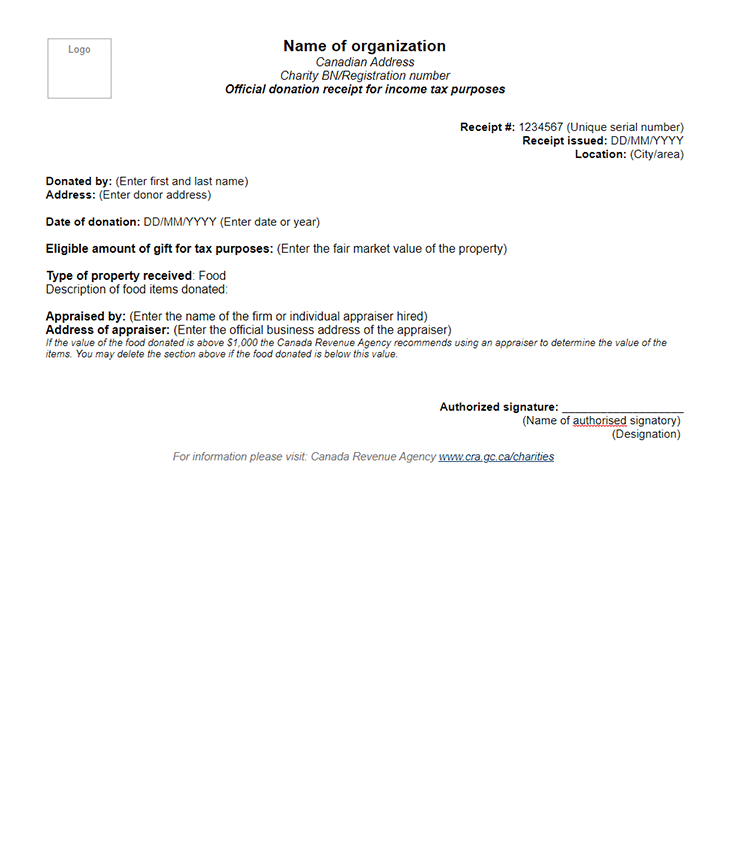

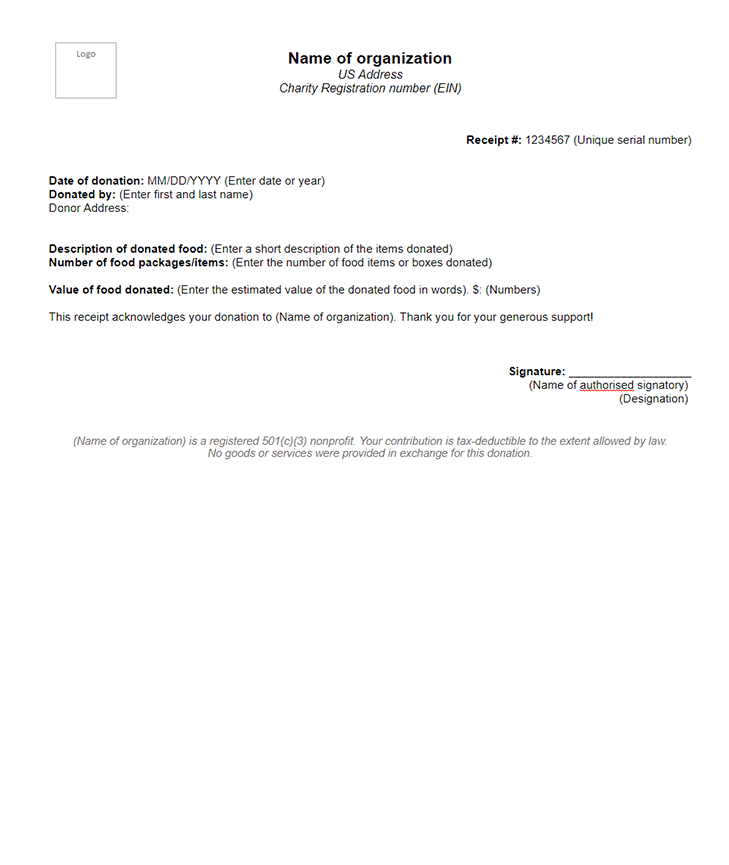

These donation receipt templates are issued when a donor receives a gift in return for a donation of items such as clothes, food, etc. The cost of the gift the donor receives must be subtracted to calculate the taxable amount.

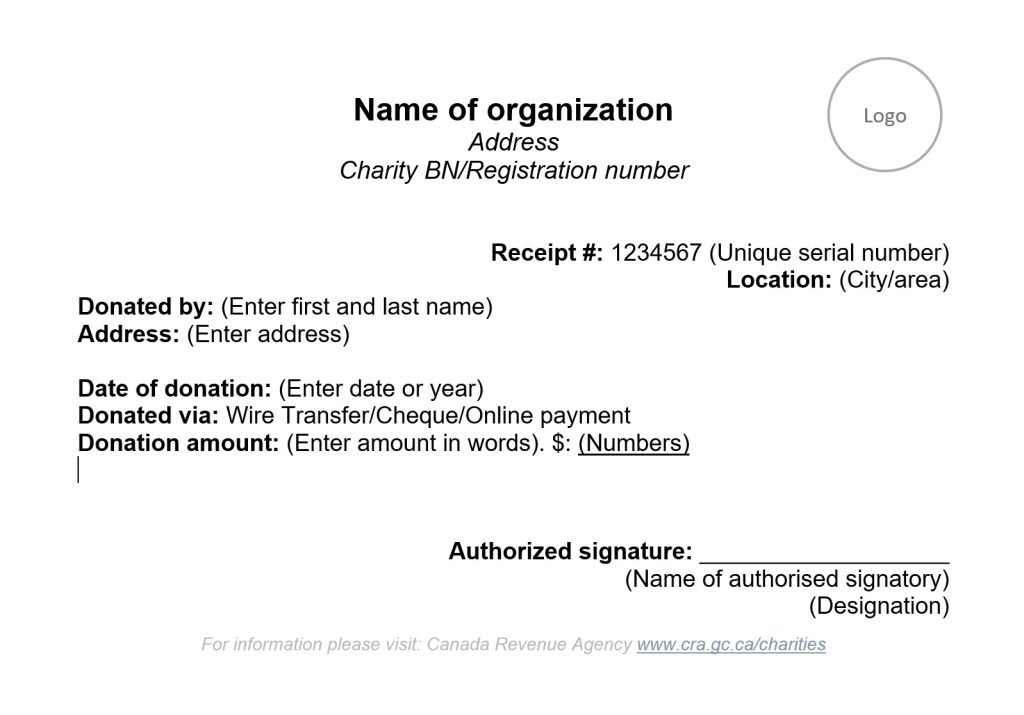

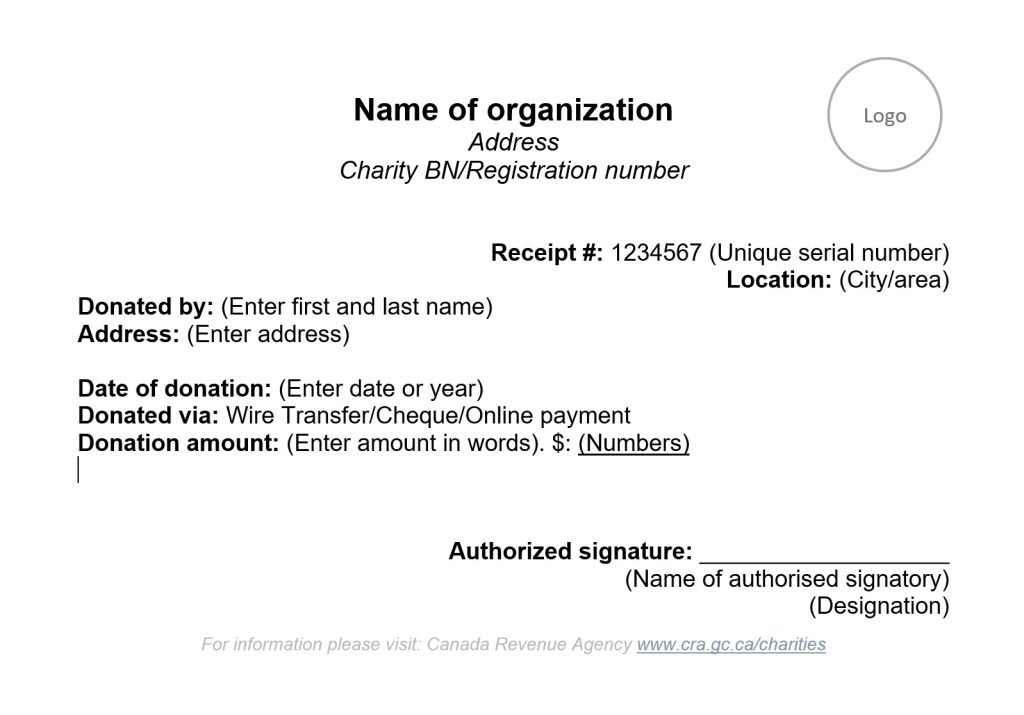

(Click image to download in Word format)

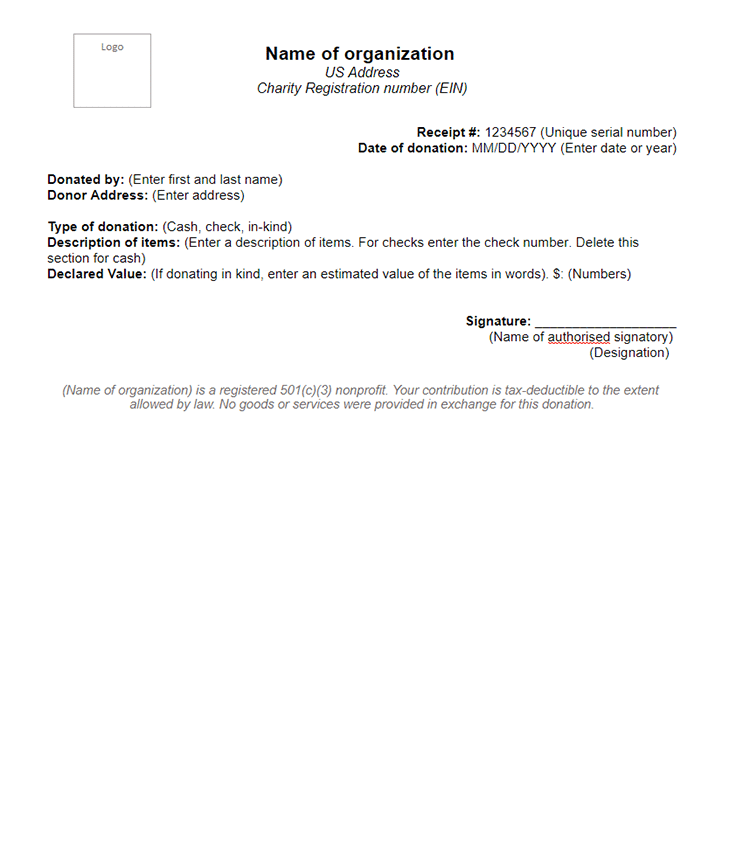

(Click image to download in Word format)

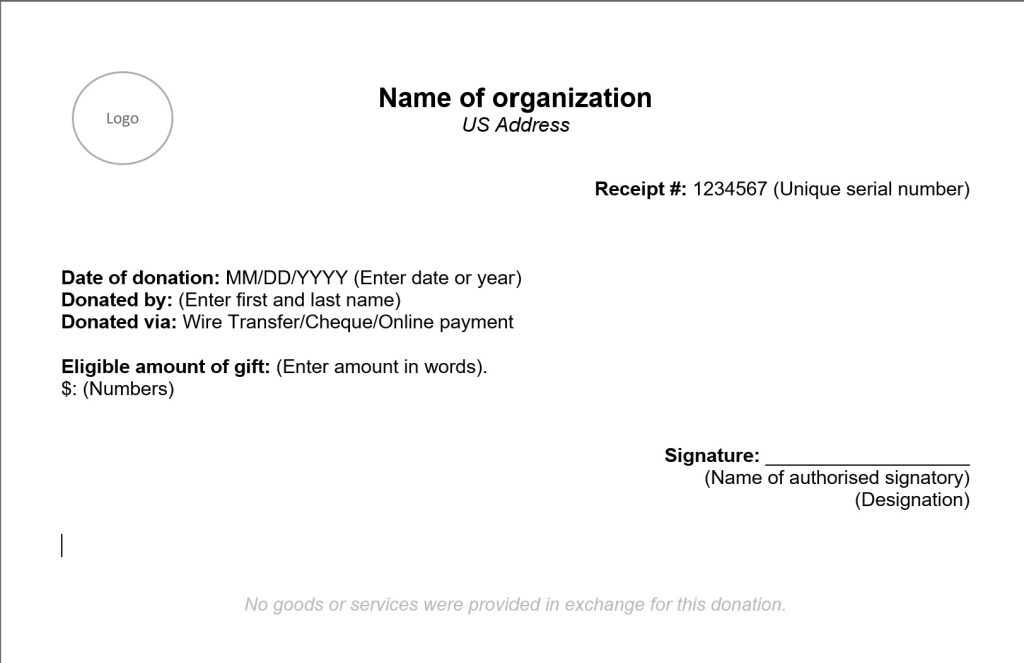

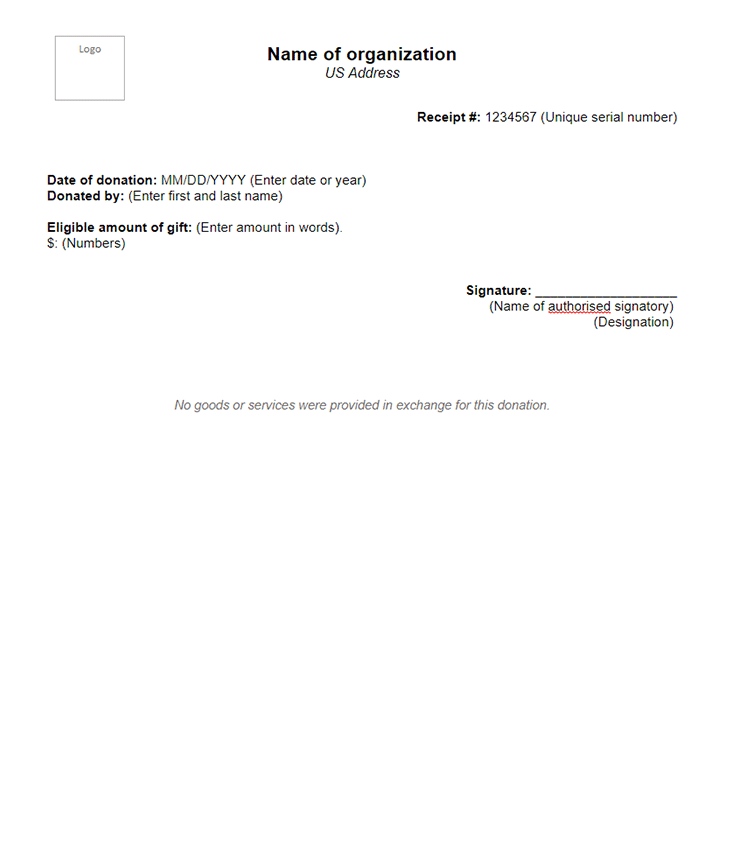

A 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation receipt for all donations. Don’t forget to include your registration number on the donation receipt!

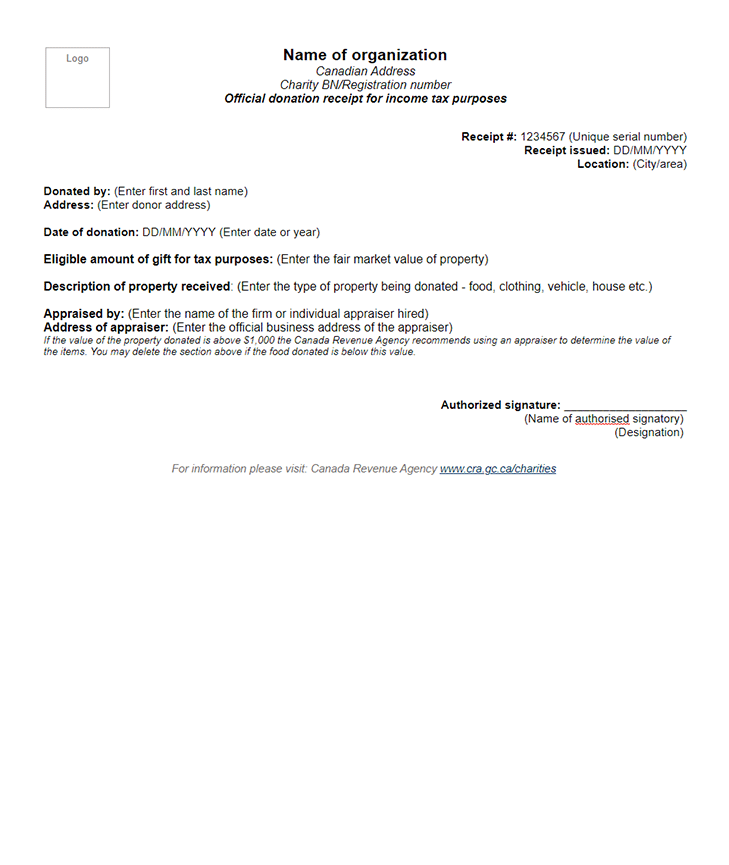

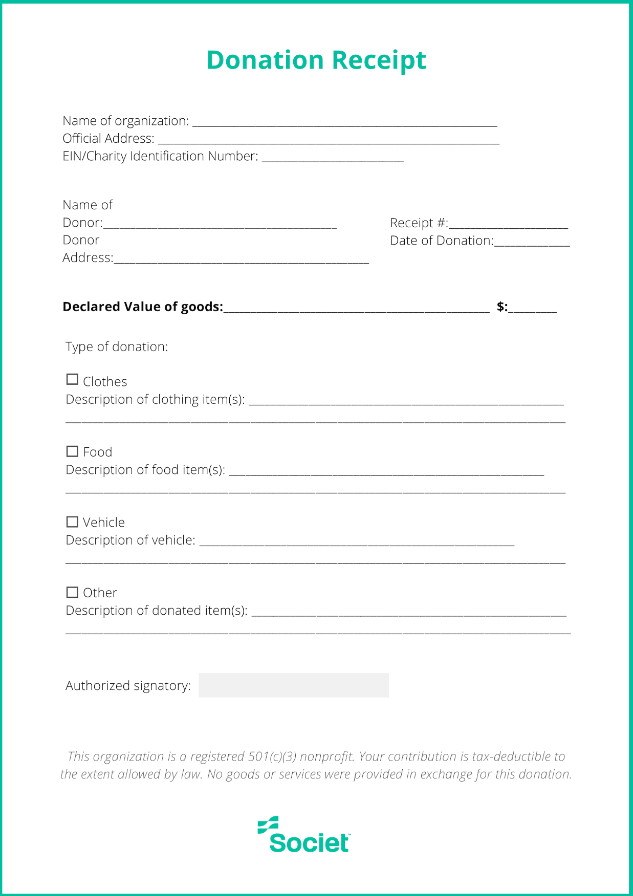

In-kind donation receipt templates are used to acknowledge donations that don’t have a clear monetary value such as food, clothes, old computers and other electronic items. If the value of the items are over $5,000 they must be assessed by a qualified appraiser, otherwise it is up to the donor to assess the items.

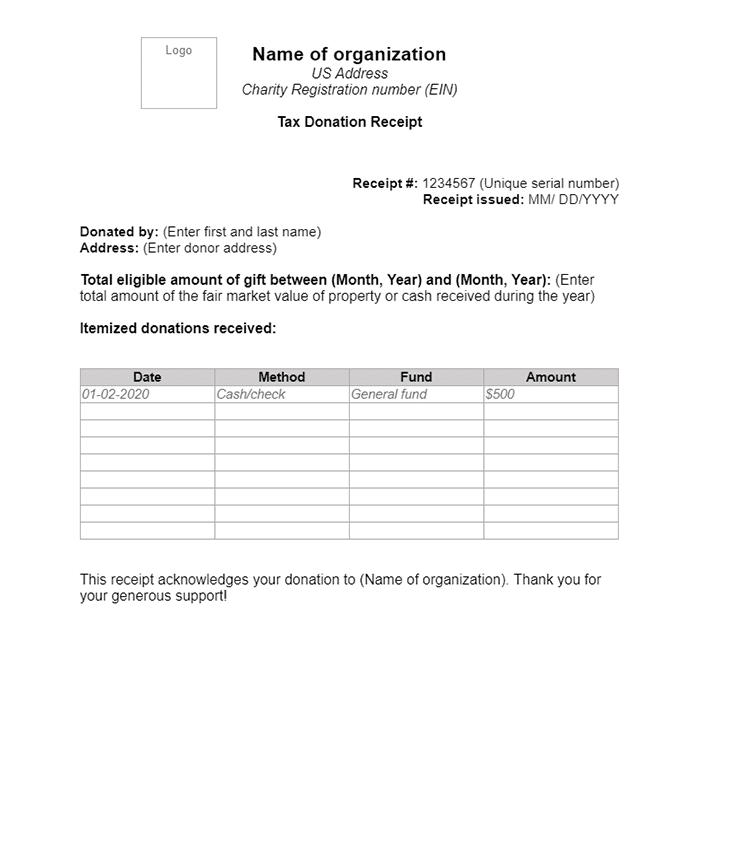

A year end donation receipt template can be issued to donors who have made multiple donations throughout the year to present them with a consolidated donation receipt for the year.

.png)

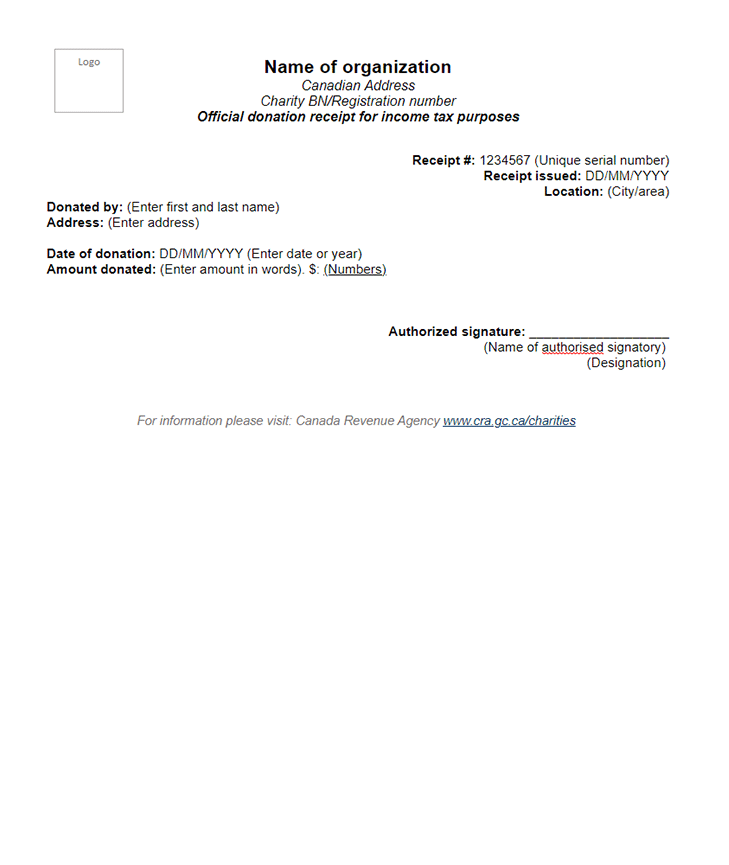

(Click image to download in Word format)

Use a clothing donation receipt template to document clothes that you have received from donors. Donors usually estimate the pricing of the items donated by a fixed percentage of an item’s original value.

If you’re running a food donation drive, a food donation receipt template will help you easily record the list of food items someone donated.

(Click image to download in Word format)

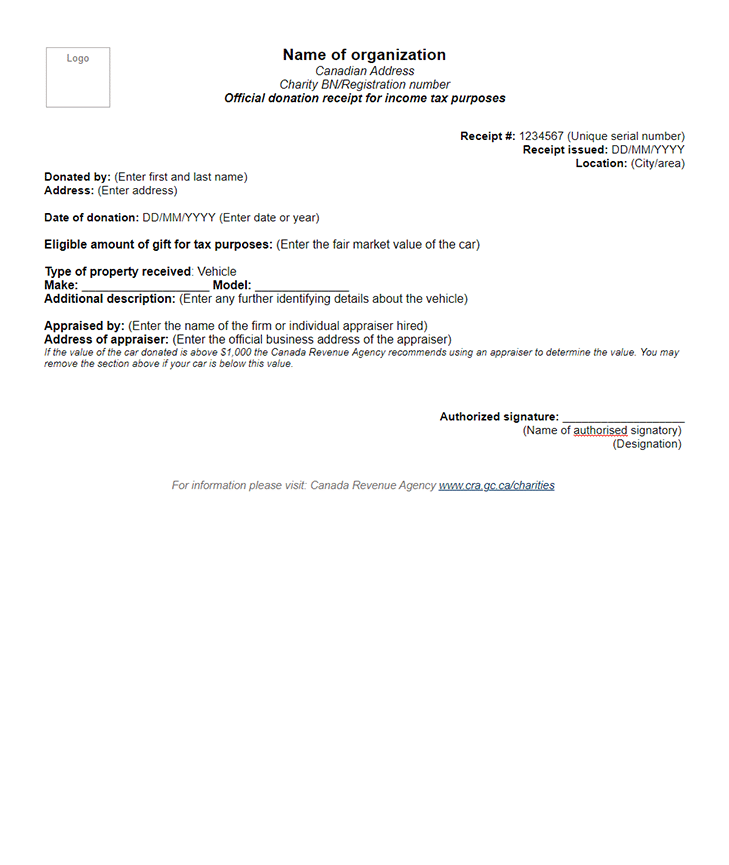

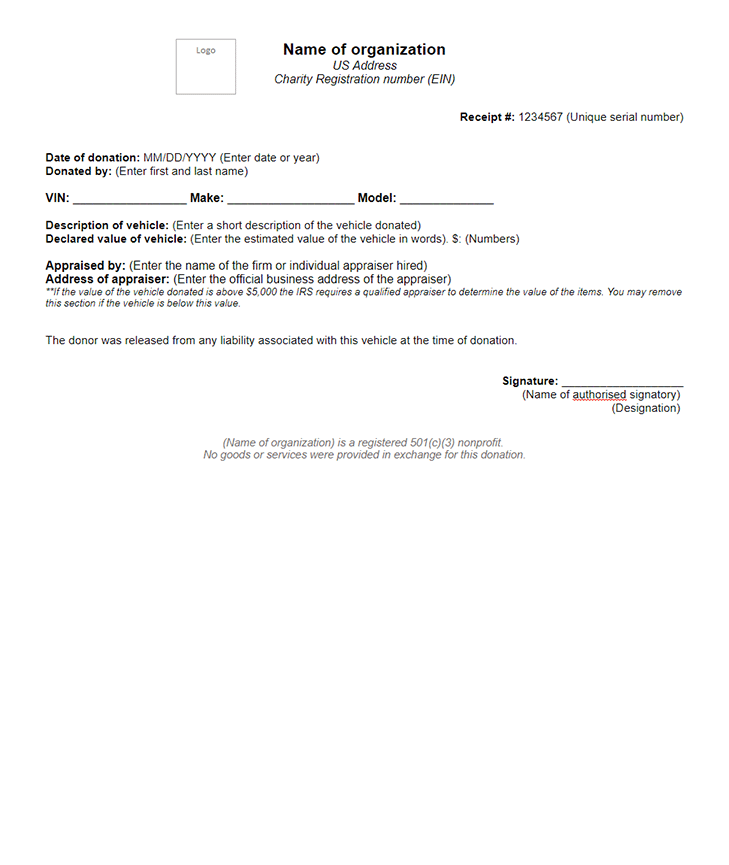

A vehicle donation receipt, also known as a vehicle donation bill of sale, must be issued once your nonprofit accepts the donation of a vehicle. The donation receipt needs to include a detailed description of the vehicle as well as it’s approximate value.

(Click image to download in Word format)

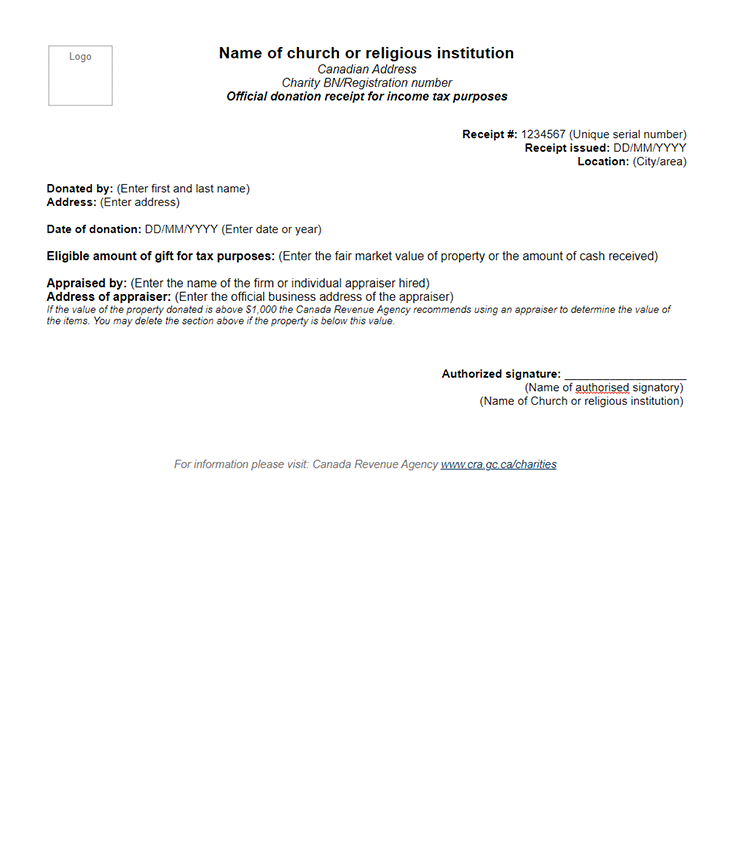

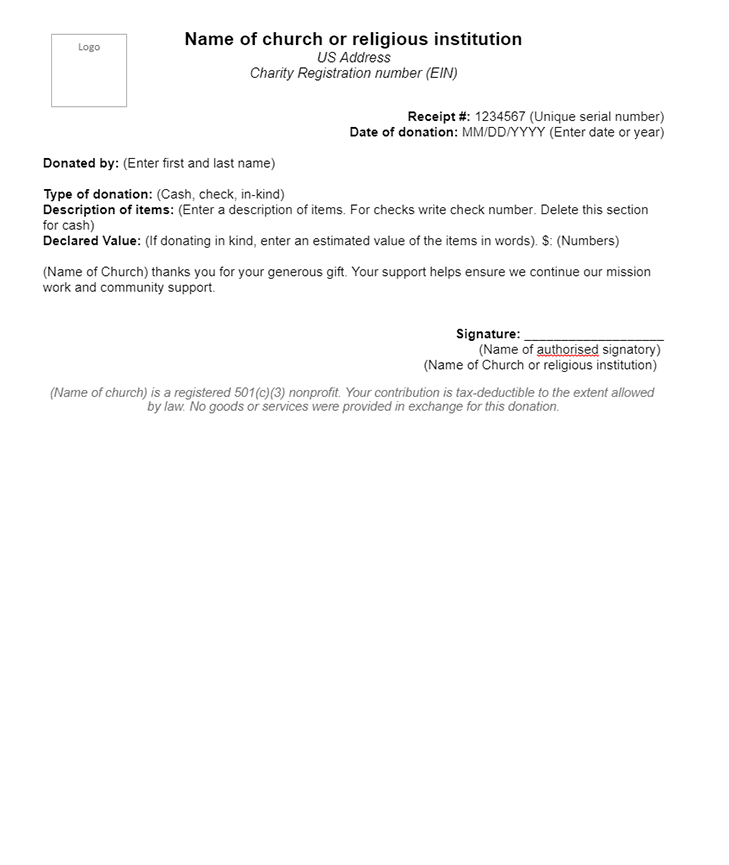

Both the US and Canada recognize religious institutions as charitable organizations for donations made to churches, mosques, temples and synagogues tax exempt. Your donation receipt will need to include the same information as a 501c3 donation receipt template and also include the name and address of your institution.

(Click image to download in Word format)

(Click image to download in Word format)

A donation receipt template is used as proof that cash or property was gifted to your charity. Donation receipts are used by charities while filing taxes and by donors to claim income tax deductions.

Besides serving as a confirmation that the gift was received, nonprofit donation receipts keep your donors happy and engaged with your cause. Most importantly, donors will use them to itemize their charitable giving when tax season rolls around. This is why sending out receipts should be the next step after you receive a donation from someone. Donors are more likely to give again if their donations are acknowledged within the first 48 hours!

Since donation receipts are used for tax purposes, if you issue a 501c3 donation receipt you will need to follow certain legal guidelines. For example, nonprofits in the US and Canada are required to store 501c3 donation receipts for a year or more after the filing was made. In Canada, nonprofits file a T3010 registered charity information return.

For detailed information on legal compliance regarding non profit donation receipts, visit the United States and Canadian official government sources.

If your nonprofit is registered outside these countries, make sure you are aware of all legal requirements in your country before you issue a donation receipt.

Pro Tip: Using a nonprofit CRM solution like Sumac’s will help you automate this process and help you send out accurate donation receipts on time – saving you a ton of time and effort.

To learn more about donation receipts, check out this guide on nonprofit donation receipts.

Donation receipts are essential for effective fundraising as it helps maintain good donor relations. Prompt donation receipts makes donors feel like their money has reached safely and lends credibility to your nonprofit. To maximize donor goodwill, don’t forget to include a thank you letter which details how their funds will be used. This will make donors feel part of your journey, deepen the relationship, and make them more likely to give again!

Here are a few other reason why you should send donation receipts:

Organizations that can issue legally valid donation receipts that enable donors to avail tax benefits include:

Only registered charities can issue 501c3 donation receipts. If your nonprofit isn’t a registered charity, you can still use these free nonprofit donation receipt templates, but donors won’t be able to claim any tax benefits against them.

Donations can be made in a vast number of ways. Depending on the nonprofit, people can donate cash, gifts, auction items, vehicles, clothing or property.

If you wish to accept such items, you will need a separate donation receipt template for each of these items (see nonprofit donation receipt templates above to select one that best suits your needs). Donation receipt templates help easily track and accurately capture critical information based on the type of donation made, so make sure your donation receipt accurately reflects this.

Nonprofit donation receipts can be sent monthly, yearly and of course, right after a donation is made. While sending a donation receipt immediately after someone has donated is a must, you can also choose to send your donors monthly or yearly updates on their giving history.

Creating nonprofit donation receipt letter templates beforehand can help you send donation receipts with ease. Make sure you set reminders and create content to accompany your monthly and year end donation receipts.

A year end donation receipt template will help donors easily file their tax returns with a single document and save them the trouble of compiling the donation receipts they’ve received during the year. You should send a year end donation receipt at the beginning of December (in the US) and before the end of February (for Canada). This gives donors ample time to file their taxes and claim benefits from their donation receipts.

Similarly, donors in your monthly giving program should receive a monthly donation receipt acknowledging their contribution along with updates about your work. If you only send donation receipts with no updates this might leave donors feeling unsure about what you’ve achieved or how their money is being used.

In Canada there is no official requirement that requires charities to send out nonprofit donation receipt letters or issue donation receipts. This means sending a donation receipt isn’t enforceable by law.

In the US, charities receiving amounts below $250 are not required to issue a donation receipt.

However, since sending donation receipts are about much more than complying with the law – you should definitely send one anyway! Even for very small amounts. As mentioned earlier, this builds good relationships with donors and makes them feel secure about giving to your charity.

Some organizations set a threshold amount below which they do not issue donation receipts – but this is to be able to better manage their workload. Automated donor management systems can help with this – sending donation receipts to every person that donates without the need to involve the team!

Issuing donation receipts are an important part of donor management activities but can be tough to track.

You can work with spreadsheets to manually track incoming donations, but this means a member of your donor relationship or fundraising team sets aside some time every two days to send donation receipts and thank you notes. This is tough to do and also can result in errors.

If you have a high volume of donations coming in, consider using a CRM software.

A donor management or CRM software like Sumac’s is the easiest way to issue donation receipts as it automates the process. This removes the possibility of error while entering donation receipt details and ensures donors receive personalized receipts on time.

There is no standard format for donation receipts in the US or Canada. You can choose to send out letters, postcards, or online receipts. Make sure you select the format that works best for your donors as well as your organization.

Here are some helpful tips to get you started:

Here are a few tips on how to manage your donation receipts:

If you spend part of your day writing out names and amounts on 501c3 donation receipt templates, it’s likely that you’ll make a mistake at some point. And if you fail to issue donation receipts for amounts over $250, your organization can incur high fines.

Here is what the Canadian government has to say about issuing donation receipts with false information:

“A registered charity that issues an official donation receipt that includes incorrect or incomplete information is liable to a penalty equal to 5% of the eligible amount stated on the donation receipt. This penalty increases to 10% for a repeat offence within five years.

A registered charity that issues an official donation receipt that includes deliberately false information is liable to a penalty equal to 125% of the eligible amount stated on the donation receipt.”

To reduce the possibility of error and make things easier for your team we recommend using an automated nonprofit management software – like Sumac!

Now you can go ahead and explore these free nonprofit donation receipt templates!

You can print out a donation receipt template pdf and issue handwritten receipts at events or customize a donation receipt template doc with your logo and donor information before emailing them to your donors.

If you’d like to automate the process of issuing donation receipts, check out Sumac’s nonprofit fundraising software which includes tools to streamline your fundraising activities and seamlessly issue donation receipts!